Using Hitwise for large, diverse sites

It occurred to me the other day that I haven’t written a post on Hitwise in a while. And it turns out that they aren’t just called Hitwise any more, they’ve changed their name to ‘Experian Hitwise‘. I’m not sure I’m going to change all my labels on the posts so that they say Experian Hitwise though, because that would be a bit over the top. It’s not like I say ‘Microsoft Word’, ‘Apple iPhone’ or ‘Adobe SiteCatalyst‘ is it? So what I decided that I’d write about was something that we’ve been doing here for a while, but I’m not sure others have been. Namely that is segmenting our site up into small bite sized chunks and then analysing some key competitors to get a view of what is going on in that section’s market area.

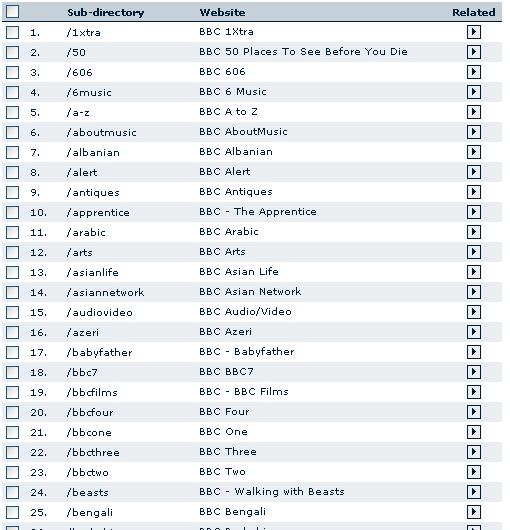

So you own a large site and you are perusing through Hitwise. You’ve managed to compare your site to the other big sites that you need to and you’re feeling pretty smug because you rank number 1 or you’ve been improving over those other sites for a while. Then the head of one of your sections comes along and says – well this is great, but my section of the site doesn’t really relate to all those other big sites – or at least not all of them. Can you tell me more about my section? Well you could do what the BBC did and set up your sections into a series of sub folders so that you can then split them out and monitor them individually:

However this comes with its own set of problems. Namely that someone has to keep telling Hitwise what they are every time you add to your list of 280(!). And more importantly, some poor soul has to create a custom aggregation to group them all together to get the overall picture. No doubt that poor soul also has to group them all together several times in his/her lifetime when they move jobs and want to compare themselves to a large, diverse site such as the BBC.

Another option you have is to leave Hitwise as it is and stop bugging the other users who want to compare themselves to you. Then you can take your section and work out what your competitors would have been if you’d done the same as above:

1. Work out what search terms you rank for and what other sites also rank for them.

You have analytics on your site, right? If not, get some. No seriously, do – it is really easy. What you want to do is find out what search terms you rank for and then go and look them up in Google. What other sites rank for those search terms? Yep – use some of those sites.

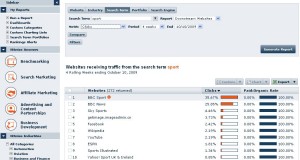

Or you can use Hitwise to find your website terms and then reverse look up who is getting traffic for that and related terms. I’d recommend using your own analytics tool – because you can then take just that section and look at the search terms. Plugging these search terms into Hitwise can give you a list of sites that you want to add to a custom aggregation and a custom category.

It’s actually really easy to add these into custom categories and aggregations because you can select the sites you want to include with their check boxes and then use the ‘Custom’ drop down at the top of the table to add them to the aggregation and category.

2. Use the upstream and downstream traffic of your already selected sites.

So you have a small group of sites already selected. But you may be missing some. Just because people think of SiteA when they think of your site, doesn’t mean that they’ll automatically rank for those search terms. But somewhere along the line SiteB will rank for the term and it will have upstream and downstream traffic to SiteA. This means you can find new sites that you may not previously have thought of.

Now you have a longer list of sites that you want to include in your custom category and custom segments, that should start to resemble a good set of competitors.

3. Ask an expert in the field

This may sound pretty dumb, but you probably work in an industry where there are lots of experts in the fields around your content. You know what – they probably read the web as well. Why not ask them what sites they like looking at? It sounds fairly obvious, but just by presenting your aforementioned list to someone who knows the subject (eg in this case Sport), then they might be able to say “Hey, you’ve missed out SiteD.” Or something similar.

Now you have a list of approved competitors to the small section of the site that you are working on – but no real comparison to how you perform against them. This is a bit of a problem, but there is a solution to it. Firstly you can take your custom categories and create a chart of them:

Now you can take that graph and add your own site into the list. This will probably cause all of the other sites to suddenly look tiny, but all is not lost. For one, you have your own analytics data which you can use to extrapolate what percentage share you think that you have for the time period and then you can export this chart into excel and recreate with your own figures. Note that this isn’t going to be perfect. Your going to be combining two completely different data sets, but the outcome should be the same – you’ll get a vague impression of how your site is performing compared to your competitors.

Whilst that is all very well and good (“Woohoo, I’m doing much better compared to my competitors that I thought”), it doesn’t necessarily give you anything that you can do to your site to help improve it. What you need to do is start looking at some of the more detailed stuff in there. Starting with search terms.

If you can monitor what search terms your competitors are picking up on, you can compare this to the search terms you know you perform on and come up with a ‘gap analysis’. That is to say “My competitors get traffic for these search terms and I don’t.” That is just the start of the conversation, of course. What you now need to do is go back to your SEO team (or if you don’t have one, read some SEO basics) and see if you can come up with a strategy for starting to rank for some of those terms. Remember, you want to rank for terms that are high value for you as well, so make sure that you measure whether the effect is having positive results not just in visits (see ‘Measuring your SEO efforts’). In fact, I’ve talked about how to drive your search strategy with Hitwise before as well.

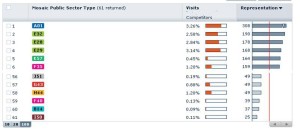

The next step is the bit that those technical, hardcore people don’t like. In fact, it’s the bit that not many people like, but provides some really interesting insight and some good questions. You need to look at your demographics and you need to look at your lifestyle groups. Don’t forget that one of the key things you want to look at is the comparison of this group to the online audience:

This comparison with the online audience will tell you whether you are over proportioned compared to the online audience or under proportioned. In the above example we wouldn’t necessarily know that the younger 25 – 34 group was so over represented if we hadn’t done this comparison because we wouldn’t have known what the total online population was for this. This can help us to build up a picture of the type of user that we should be aiming for. In the above example the users are over represented by 25 -34, but under represented at 18 – 24. However these aren’t large swings that we would pay too much attention to.

The lifestyle part of the site can help build an even clearer picture, we start to get big differences in the type of user and the overall population. For example in my sample set that we used at work recently, this is the top and the bottom:

As you can see, one section (the A01) is so over represented it isn’t really funny. And you can use the information that Experian has on these user groups to work out how you are going to market to them and what you should be thinking of cross selling to them. Our A01 are so rich that they’ll never need to think about financing, they live in inner city areas and are well educated. But also do think about the environment and what they can do to help that. So clearly in our marketing we should be thinking about going for the sites that think about the ‘green’ world, rather than sites that are offering loans willy nilly.

This post has now gone on for far too long (and taken me four sittings to write), so I’ll end here. Next time I write, remind me to talk about how you can use the search facility in Hitwise to find similar sites for your chosen demographic or lifestyle to further your marketing.

Leave a Reply